The market is ultimately what determines the value. When you sell something at a certain price, that value becomes what you sell it for. International valuation standards defines market value as ”the estimated amount for which a property should exchange on the date of valuation between a willing buyer and a willing seller in an arm’s-length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently, and without compulsion.” where property in this instance can be exchanged for website or web business.

1. WHY VALUATIONS ARE TRICKY

As value is derived from a sale, there is no true correct answer, only opinions. Only the opinion of the valuing party can alter value. Value can vary based on the buyer, market conditions, valuation methodology applied, purpose of the valuation, presentation of the assets and more. There is no “set criteria” nor is there rules of thumb that apply in everyone scenario. In this article I will try to help you on how to form one.

2. HOW VALUATION CAN VARY

The purpose of a valuation and the model that you apply to a website will result in drastically different values. Let’s say, for simplicity you had a website making $10 million dollars a year in sales and $9 million in expenses. Making the total net profit of the business $1 million. If you applied a multiple of earnings model at say 3 times earnings the business would sell for $3 million dollars. However if you applied a liquidation valuation to the business and the business had $7 million dollars in assets on the books at auction value you would get $7 million dollars for the business. A drastic difference!!! A public example of this is Digg.com. which had about $10 million dollars in revenue per year and a similar amount of expenses. According to TechCrunch the sale value of Digg was about $16 million, Washington Post Co. paid about $12 million for the Digg team; LinkedIn paid $3.75-$4 million for patents; and Betaworks bought Digg’s remaining assets for $500,000-$725,000.

3. WHAT IS MARKET VALUE TO WEBSITE BUYERS

The reason that a website has a market value to a buyer is because of a potential profit from it. Buyers are solely motivated by return on investment, so if you are thinking “my website has so much potential” by economics you are wrong. But hang on, Instagram was sold for $1 billion dollars and it hadn’t even made a cent! Well i’m sorry to say your website is no instagram. And when you are dealing in the private markets (which is what you are dealing in), value is determined by what someone is willing to pay for your website which is determined by its ability to make a profit and present a reasonable rate of return for its purchaser.

4. WHAT DOES NOT ADD VALUE

The assets that make up a website (like domain name, trademarks, copyright, graphics, programming, databases, email lists, form, content and traffic) are what determine the revenue (more specifically profit) of the website, and it is that profit that will determine value to buyers. Some website owners struggle with the idea that, just because they’ve put all this effort into creating content and doing SEO, their website inherently has value. I’m sorry to tell you this, but in terms of valuation 1 + 1 doesn’t equal 2.

5. HOW DO WEBSITE BUYER DETERMINE VALUE

Let’s have a look at some general facts about valuations

- Valuation is a combination of objective and subjective tasks

- A valuation is really only an opinion of what something will sell for

- Real value only materializes when something is sold

- Website sellers generally over value their website

- The higher quality data (proof of income, traffic stats etc.) the higher quality valuation

- There are always macro factors out of the control of the buyer and seller that affect value

- Valuation models vary and there is no one “correct” valuation for a business

Website buyers typically pay a multiple of earnings for a website. That is they pay a multiplication of how much net profit the website makes per year. For example if your website makes $100,000 per year. A buyer may adopt an earnings multiple of 1.5X thus they will offer you $150,000 for the website. Generally the higher the risk the website holds, the lower the multiple they will offer. The basic valuation method used to value websites: Net Income x A Multiplier = Your Website Value

Here is a breakdown of the two:

a) Net Income (profit) is calculated by taking revenues and adjusting for the cost of doing business, depreciation, interest, taxes and other expenses, or in accounting speak EBITDA. Generally speaking there are less expenses for a web business as you don’t normally have things (rent, office expenses and general normal business expenses). So there is normally less calculation to do than in a normal business valuation. A lot of money can be saved by understanding the actual profit that you are really making. That is why bigger companies pay ridiculous multiples for companies. They can see the synergy and economies of scale by cutting costs and expenses to bring the overall profit level up.

b) A Multiplier A simple multiplier will be based on a Rate of Return. If we use the following: 12 Times Month Multiple = 100% return – and your money back in one year / 24 Time Monthly Multiple = 50% return – and your money back in two years / 36 times Monthly Multiple = 33% return – and your money back in three years. You are beginning to see why internet businesses are becoming a good investment as an investor. With minimal staff and expenses to worry about, the business starts to look quite attractive. Much better than putting your money in the back and getting 1-5% interest, depending on what country you are in.

6. DETERMINING THE TRUE INCOME

Let’s take this simple example: A blog that is monetized through advertising.

Explanation: This business makes a total of $300,000 per year. The business has expenses of $172,500 giving a net profit of $127,500. However when we add back in the expenses that the new owner will not inherit the true net profit turns out to be $167,500. Now if that site sold for a multiple of 2X. That would mean the difference between sale prices of $255,000 versus $335,000 is $80,000.

Why do you add back those items? Repairs/Maintenance is added back as it is considered a discretionary expense to Directors. (This expense is for repairs and maintenance on assets owned by the directors and thus is not an expense the new owner would inherit). Auto Expenses is added back as it is considered a discretionary expense to Directors. (This expense was for a vehicle owned by the director and is not included). Meal, Travel and Entertainment is added back as it is considered a discretionary expense to Directors.(this is a discretionary expense of the Director and should not be inherited by the Director.) Interests – has been added back to achieve an adjusted EBITA for the year (this expenses was for a loan the Director had on a property they owned and is not inherited by the new owner). Add backs are expenses that are added back into the profits. The theory behind add backs is that they are deemed one off, extraneous, and/or owners expenses.

Some examples of legitimate add backs include:

- owners compensation

- personal expenses (of the owner)

- tax and benefits

7. WHY YOU CAN’T TRUST ONLINE TOOLS

If I go and see the value of Google.com using the following tools I get the following results:

- http://www.dnscoop.com: $2,246,400,000

- http://www.worthofweb.com: $ 78,650,521,400

- http://sitevaluecheck.com: $710

- http://digsitevalue.org: $1 365 751 473

With a range between $710 and 78 billion you can appreciate why automation doesn’t equal accuracy. That range is a factor if 100,000,000%. Why such a disparity? Because many of these online tools operate the mathematical and scientific foundations of “ tarrot cards or astrology”.

What Multiples Do Buyers Pay? Multiples vary based on market sentiment, supply of sites coming up for sale, number of buyers in the market, the synergies that buyers may recognize, timing, location of listing, credit offered by seller, form of payment, or the buyer’s mood on the day!

- First Timers – 1.5x – 2.5x multiples

- Financial Buyers – 1x-2x multiples

- Strategic Buyers – 1x-3x multiples

- Investors – 1x-3x multiples

What Types Of Sites Sell For More? I don’t believe there are “common valuation multiples” or that it would be a helpful figure if it were calculated. Each site is individual and each buyer has his own perspective on what he can do with the site and what he’s willing to pay for the revenue streams and risks he envisages. But it is common to throw around the multiple of 1-2 years of net income as a starting base and things go up and down from there. I don’t think it’s really a question of an AdSense site gets 1-2x yearly net and an ecommerce site gets 2-3x. It all depends on the site and who’s buying it. Big dumb companies buy up companies at insane multiples to gain market share or push out the competition. There are two major value variables that can alter value:

- The consistency or scalability of revenue

- The quality and reliability of website traffic

The strength of these two factors can be affected by the following variables

a) Industry

- How competitive

- Low barrier to entry

- Future of the market

- Any vertical or horizontal integration

b) Income

- One source of income? Stable?

- What is the ratio costs to profit

- Active customer base

- Clean finances

c) Traffic

- Multiple sources of traffic

- Referral traffic

- Reliance on Google

d) General

- Age of Site

- Unbroken Whois history

- Brand and goodwill

- Previous owners

- Technical Knowledge required

- Solid earnings

- Positive growth trend

- Processes automated

- Defensible Market (a site on CD’s has little value today)

- Room for growth

- Strong Brand

- Diversification (of revenue and traffic)

- USP (some type of unique asset)

- Key assets (like email list, premium domain, supplier contracts etc.)

- Legal Liabilities

- Quality evergreen content

- A commercial demographic (10,000 doctors is better than 100,000 teenagers)

e) Other factors:

- Can the owner make money from day one?

- What level of input does the current owner have in making the site function (are they too close)

- Is location a factor in earnings

- Are there special requirements (licenses, certificates) to run the business

- Are their any special needs of vendors or suppliers

- Any debts

- Documented Operations Manual

- Seller involvement post sale

8. HOW TO GET HIGHER VALUE WHEN SELLING

- Performance Goals: pay on certain milestone or goals achieved.

- Seller Financing: finance the acquisition as seller financing or some type of payment plan.

- Ongoing Support: provide ongoing support this can reassure the new buyer.

- Part Ownership: take a monetary interest in the future of the website can help increase price.

- Non-Compete: sometimes a clause about not competing will tip the sale in your favor.

9. CASE STUDY “A”:

Why some people can afford to pay more for a website: Let’s say you see a site that you already own in a similar market and that this site converts at 10%. The site you are looking to purchase converts at 5%. Let’s imagine that site has been valued at 36 times monthly earnings for a total of $300,000 (Buy It Now Price). If you were an “unfair” buyer in that particular market you would happily pay the 300k and get your money back in three years. However as an “fair” buyer, you can afford to pay twice the money $600,000 giving it a 72 times monthly earnings multiple and outbid any “unfair” competitor, knowing that by improving the conversion rate from 5% to 10% you can get your money back in the same amount of time and thus can afford to spend more on the site to secure it. You can now see how one person can value a site at X, then another person value a site at Y. That is why at the end of the day the market tells you what a site is worth.

10. CASE STUDY “B”:

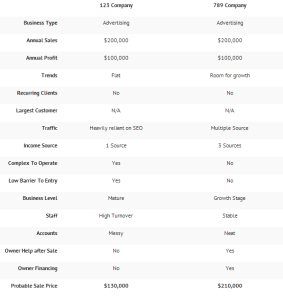

Same income different value: This should give you a better understanding of why similar businesses sell for completely different amounts.

Although the two websites have the same annual profits, the above data suggests that company 789 will probably sell for more than company 123, maybe even twice or three times the amount. This highlights how “rules of thumb” and “industry standards” are useless in some aspects and value is such an individually past aspect.

11. VALUATION METHODS

Below is a list of valuation models that can be applied to a business.

a) Valuation Models

- Capitalisation of future maintainable earnings

- Discounted cash flow

- Nett asset backing

- Net realisable value

- Replacement cost

- Liquidation value

- Capitalisation of dividends

- Return on investment

- Industry rule of thumb

- Comparable market transactions

- Cost to create

- Multiple of earnings.

b) Common Methods

- Asset Valuation: buyers may make their valuation based on the assets of the website (traffic or customers), they will look how to leveraging those assets to get a quicker return on investment.

- Future Maintainable Earnings: buyers might look at the rate of return they can expect from the website by capitalizing future earnings multiplying the average profit by the desired RoR.

- Earnings multiple: buyers may apply earnings multiple to your website (1.5X…)

- Comparable sales: buyers may search for similar sales to find comparable sales data and use this as a basis for making an offer.

- Discounted Cash Flow: Buyers might look at the cash flow received for the investor discounted at a return on investment rate required form the investor. This valuation model takes into account the time value of money.

12. CONCLUSION

As you can see there are a multitude of things that can come into factor in the eyes of the buyer. Understanding them as a seller will enable you to sell better your site. Depending of all these factors, you might get to the conclusion to hold onto the sale of your website for another year, because you will likely get double or even triple the money at that time. It is important to remember that the market is made of thousands of buyers and each and every one of those people will have a different point of view and methodology to value your web site.

I hope you will be able to build this complex framework when trying to put a value on your site. Never assume that the price you think you can get is what you will get. You will be surprised the creative ways people come up with to get their hands on your website. At least you’ll have a tool to help you to defend a price where both parties will be happy at.

GOOD LUCK !!!!

______________________________________________________________________________________________________

PDF DOCUMENT AVAILABLE @ http://www.scribd.com/doc/139423395/HOW-TO-PUT-A-VALUE-TO-YOUR-WEBSITE-2013

Leave your questions and comments to: herve@delhumeau.com